Advisory & Intermediaries

Welcome to Jalia Advisory & Intermediaries, your trusted partner in investment planning and strategy. We are dedicated to empowering investors to meet their goals with tailored investment solutions.

Portfolio

Govt Securities

Unit Trust

Stocks

Crypto

Offshore

Top Devidend

tech giants

tech giants

Unit Trust

About Us

We empower our clients with sound financial guidance, helping them achieve their long-term goals and secure their financial future.

We are committed to providing personalized, transparent, and ethical advice, tailored to each client’s unique needs.

Invest in a Portfolio, not Assets

Factors to Consider When Selecting an Investment Manager

When selecting an investment manager, consider their investment strategy, performance history, client service, and company stability. Ensure their approach aligns with your goals, review their consistent performance, evaluate their communication and responsiveness, and assess the firm’s reputation and financial health for reliable service.

Investment Strategy

Ensure their approach aligns with your financial goals and risk tolerance. Different managers may focus on growth, income, or a balanced strategy.

Client Service

Evaluate their communication and responsiveness. A good manager should provide regular updates and be available to address your concerns.

Performance

Review their track record over various market conditions. Consistent performance, rather than short-term gains, is often a better indicator of reliability.

Company Stability

Consider the firm's reputation, financial health, and longevity. A stable company is more likely to provide reliable and continuous service.

Investment

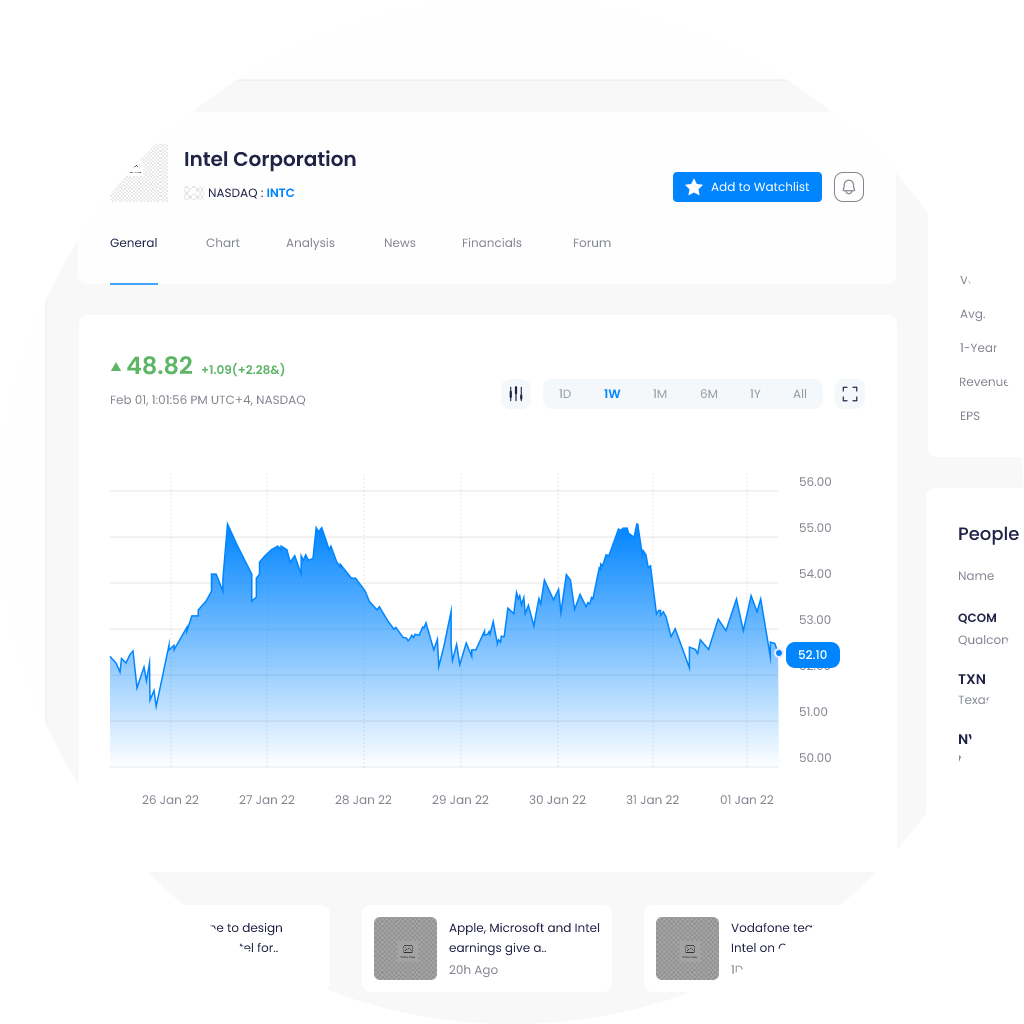

Stock Markets

Investing in listed companies offers high long-term returns with a minimum of 100 shares. You benefit from market value changes and annual dividends, taxed at 5%. However, it’s highly risky due to investment volatility. Balancing potential rewards with risks is crucial. How do you feel about this investment approach?

Government

Debt Securities

Investing in government debt offers stable returns with a minimum investment of Ksh 50,000. These securities provide a fixed interest rate, with a tax rate on interest ranging from 0% to 15%. The main benefit is high income potential, but the downside is limited liquidity, as funds are not easily accessible before maturity. Consider these factors based on your financial goals.

Offshore

Markets

Investing in developed and emerging markets offers diverse opportunities and challenges. With a minimum investment of $1,000, returns come from market value changes and periodically distributed income. Tax rates vary by country and asset type. Positives include hedging against inflation and faster transactions for imports. Negatives involve high double taxation risks and ongoing geopolitical concerns.

Measures the stock performance of 30 large, publicly-owned companies in the United States.

Tracks the stock performance of 500 large companies listed on stock exchanges in the United States.

Includes over 3,000 stocks listed on the NASDAQ stock exchange, primarily technology and internet-related companies.

Represents the 100 largest companies listed on the London Stock Exchange by market capitalization.

Consists of the 40 major German companies trading on the Frankfurt Stock Exchange.

Tracks 225 top-rated companies from various sectors on the Tokyo Stock Exchange.

The benchmark index for all stocks traded on the Shanghai Stock Exchange in China.

Captures a broad range of companies from various frontier markets, which are smaller and less accessible than emerging markets.

Unit Trust Funds – MMF & Fixed Income

These investments offer diversification with a low minimum of Ksh 1,000. The floating interest rate means returns can vary, which has pros and cons. You can access your money quickly and benefit from professional management, but daily interest rate changes due to the fund manager’s strategy mean you should manage your expectations when calculating the return you expect to earn from the investment. The 15% tax on interest also affects your net gains.

Holds Interest Bearing investments denominated in Kenya Shilling that mature within 12 months

Holds interest-bearing Dollar denominated investments maturing within 12 months.

Holds interest-bearing investments denominated in Kenya Shilling that can last for more than 12 months e.g. 5 years.

Fixed-income funds with special features.