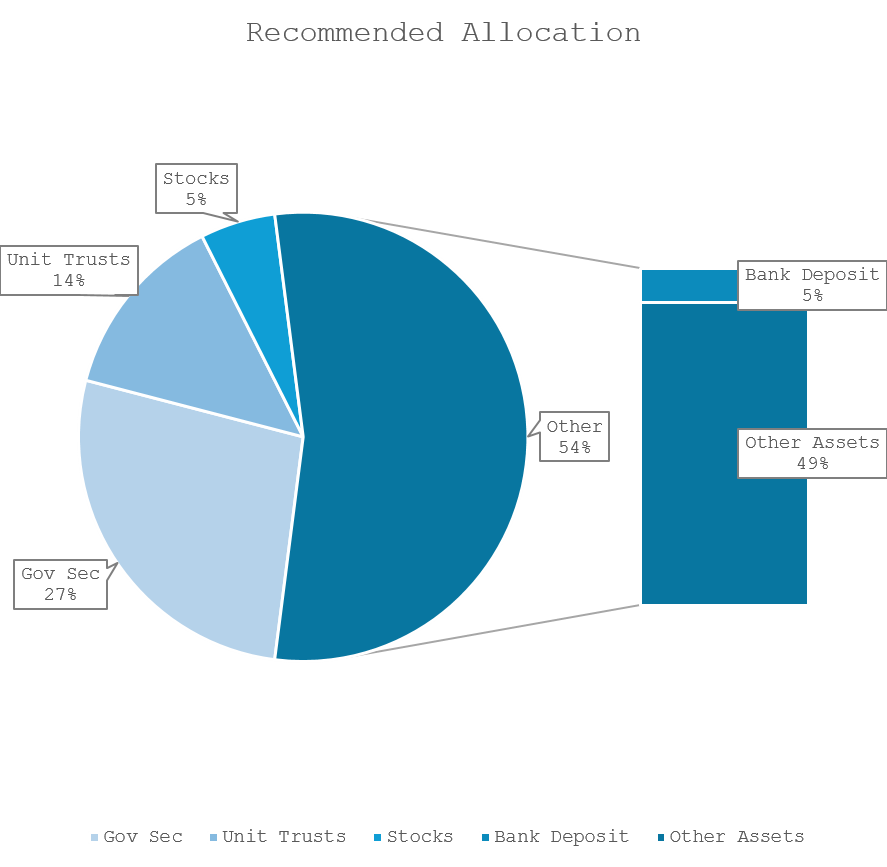

Our Portfolio

To enhance portfolio income, focusing on investments that offer higher interest rates or dividends is key.

Diversification across various asset classes, including dividend growth stocks, can provide a steady income stream and potential for capital appreciation.

Additionally, foreign currency investments can serve as an effective hedge against interest rate risk, protecting the portfolio’s value against currency fluctuations. Strategic reinvestment of dividends and interest can compound wealth over time, further bolstering portfolio performance.

Govt Securities

Participating in government auctions for 3-month T-bills can be a strategic move for immediate cash flow needs in 2024, while purchasing Infrastructure Bonds (IFBs) in the secondary market may serve as a prudent long-term investment. The tax-free status of IFBs can indeed provide a higher yield, making them an attractive option for investors seeking bonds with a high-interest rate, such as 17%, and a maturity period of approximately six years.

In the last 2 years Kenya’s government domestic debt structure shifted towards a higher reliance on Treasury bonds, with a notable decrease in the proportion of Treasury bills. The gross domestic debt and total public debt both saw significant increases, indicating a growing debt burden. The composition of debt by holder also changed, with a marked increase in the share held by other investors, while the share held by pension funds and banking institutions decreased. This shift suggests a diversification in the sources of domestic debt financing. Overall, this reflects a expanding debt profile with changes in the composition and holders of the debt, a positive sign.

Unit Trust

In light of the current economy, maintaining positions in money market and fixed income funds is a conservative strategy that prioritizes stability amidst low returns from bonds and equities.

Diversification into top-performing unit trusts is a sound approach, considering factors such as investment risk, the fund manager’s capital adequacy, profitability, customer service, and again, investment risk.

The appreciation of foreign currency and heightened foreign interest in Kenyan stocks present a compelling case for reallocating investments towards equity and balanced funds, which may offer greater potential for returns in a favorable economic climate.

Stocks

In the landscape of investment strategies, high dividend-paying stocks like Safaricom and BAT have traditionally been seen as a means to bolster cash flow, particularly appealing to investors seeking steady income streams.

On the other hand, growth stocks such as Safaricom, KCB, and Equity Bank offer potential for capital appreciation, suitable for more aggressive portfolios looking to capitalize on earnings surprises and market momentum.

However, investors must be cautious of external factors such as government stock price fluctuations, which can significantly impact market dynamics and investment outcomes.

Cryptocurrency

The investment strategy outlined focuses on a diversified cryptocurrency portfolio, with a mix of stable coins like Bitcoin and Ethereum for stability, and growth-oriented coins such as Solana and Chain link. The approach includes using trading bots to capitalize on market dips within a 10% price range, aiming to realize profits from positions established earlier in the year.

A significant development in this strategy the SEC’s recent approval of 9 ETH ETFs indicates legislative confidence in Crypto markets that would see the coin hit $5,000 mark+. BTC slated to hit $100,000 by EOY. That makes 22 Crypto Futures ETF applications approved by the SEC in 2024.